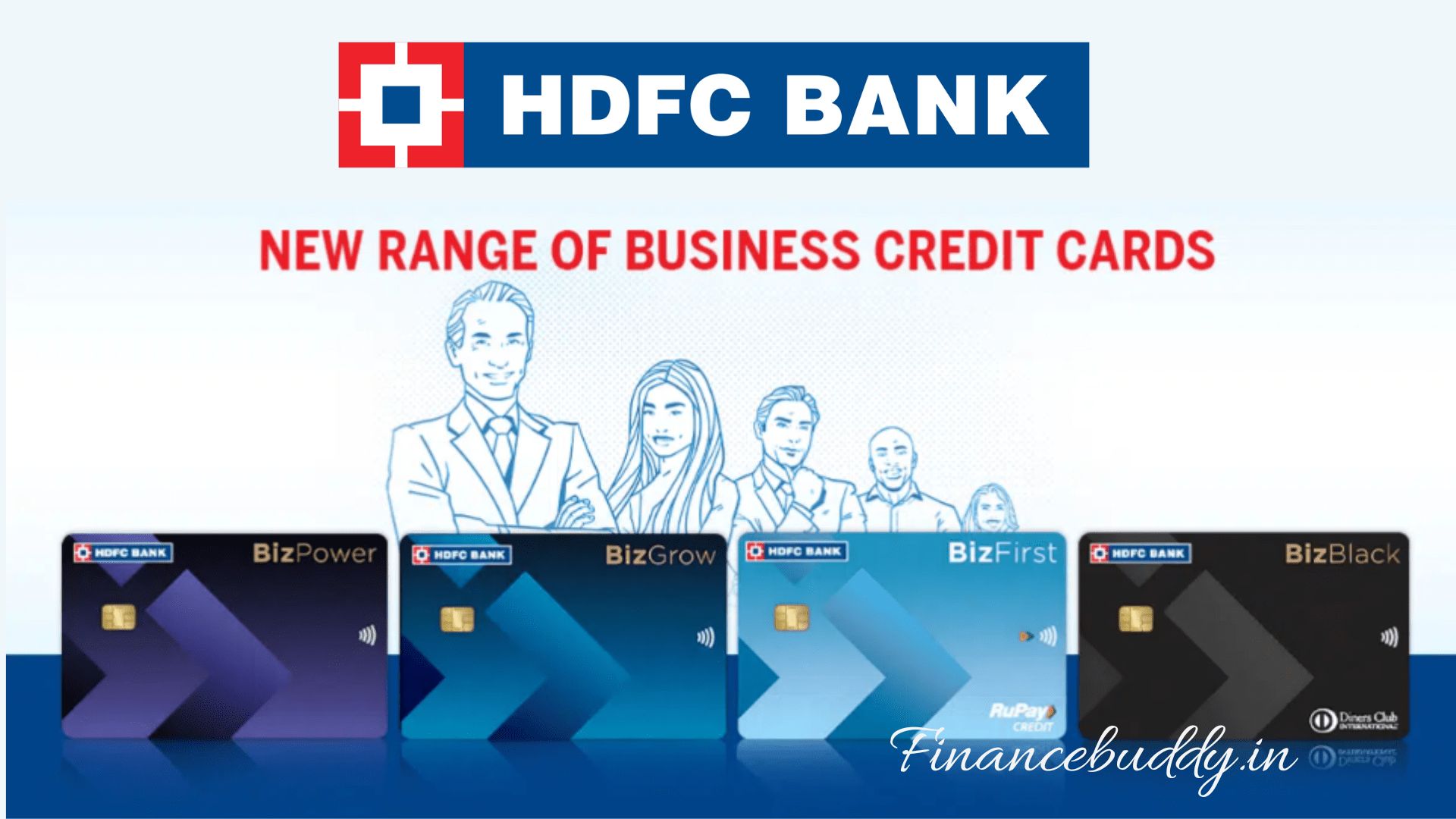

HDFC Business Credit Cards New Range Introduced.

The credit card market in India is growing at a rapid rate. And almost every bank is trying to increase its customer base.

One of India’s biggest private banks, HDFC Bank, has launched an exciting range of business credit cards to cater to the diverse needs of business owners.

This new lineup includes four exclusive cards, each offering unique benefits and features. Business owners can apply for any card according to their needs and eligibility.

HDFC Business Credit Cards

BizBlack Metal Edition:-

HDFC BizBlack Metal is for specific premium credit card users looking for an ultra-premium card with high rewards on business spending.

BizBlack Metal Card Benefits:

Unlimited airport lounge access for added luxury during business travels.

5X Accelerated Reward Points on various transactions.

Rewards: 5 points on each business spend of ₹150.

Joining/Renewal Fee: ₹10,000 + GST.

Renewal Fee Waiver: On spends of ₹7.5 lakh in a card anniversary year.

Biz Power Credit Card

Biz Power is a mid-range card balancing affordability and benefits. Card users looking for a mid-range Premium credit card for their business use can apply for this.

Biz Power card benefits:

Domestic airport lounge access across India.

5X Accelerated Reward Points on specific transactions.

Rewards: 4 points on each business spend of ₹150.

Airport Lounge Access: 16 free domestic lounge visits per year.

Joining/Renewal Fee: ₹2,500 + GST.

Renewal Fee Waiver: On spends of ₹4 lakh in a card anniversary year.

Biz Grow Credit Card

HDFC BizGrow Credit Card is an Ideal choice for small businesses with significant rewards and a low joining cost.

10X Bonus cash points on specific transactions.

Rewards: 2 CashPoints on each business spend of ₹150.

Joining/Renewal Fee: ₹500 + GST.

Renewal Fee Waiver: On spends of ₹1 lakh in a card anniversary year.

BizFirst Credit Card

HDFC BizFirst credit card is an option for business owners or self-employed individuals looking for a beginner card for business-related spending.

Offers 55 days of interest-free credit and CashPoints on essential expenses.

Rewards: 3% CashPoints on EMI spends, 2% CashPoints for utilities, electronics, and more.

Joining/Renewal Fee: ₹500 + GST.

Renewal Fee Waiver: On spends of ₹50,000 in a card anniversary year.

HDFC Bank’s new business credit cards are for all kinds of businesses, whether they’re small startups or big companies.

These cards give special benefits like personalized rewards and exclusive perks, taking care of the specific money needs of businesses in various fields.

With HDFC Bank’s Business Credit Cards, businesses can get lots of benefits to help them do well in today’s tough competition.

How To Apply for HDFC Business Credit Cards?

These Cards are specifically launched for business owners. Business owners with a minimum 6 Lac ITR and Credit score above 740 can apply for HDFC business credit cards.

Eligibility Criteria For HDFC Cards –

Self-Employed:-

Age – 21 to 65 Years

Income – An Annual ITR Minimum of 6 Lac to 12 Lac (According to card variant)

While applying for HDFC Credit Cards you would have to submit documents like PAN Card Copy, Passport Size Photograph, ITR Copy, And Address Proof.

Also read:-

Great insights shared in this article! Managing personal finances can be daunting, especially with the ever-changing economic landscape. The tips provided here offer practical and actionable advice for anyone looking to secure their financial future. I particularly resonate with the emphasis on creating a diversified investment portfolio to mitigate risks. It’s crucial to stay informed and adapt our financial strategies accordingly. Looking forward to more informative posts like this one!

This is the Best Financial Blog in India