In recent years, India has witnessed a surge in the availability of loan applications, offering easy and instant access to funds.

Unfortunately, this convenience has given rise to a new breed of financial fraud: fake loan apps.

These malicious applications have targeted unsuspecting individuals, luring them into financial traps and causing significant distress.

In this article, we will explore the issue of fake loan apps in India, highlighting important points to note, government actions taken to address the problem, and how individuals can identify and avoid falling victim to these scams.

Also will share a fake loan app list to identify the applications banned by RBI.

Fake Loan Apps in India: Identifying and Combating the Scam

I. The proliferation of fake loan apps in India

A. Rise of digital lending platforms: The increasing popularity of smartphones and the internet has led to the emergence of numerous digital lending platforms, providing quick and hassle-free loans.

B. Exploitation of financial vulnerability: Fake loan apps often target individuals facing urgent financial needs or those who lack access to traditional banking services.

They exploit their vulnerability by offering instant loan approvals with minimal documentation.

II. Important points to note about fake loan apps

A. Lack of regulatory oversight: The rapid growth of digital lending platforms has outpaced regulatory frameworks, making it easier for fake loan apps to operate unchecked.

This regulatory gap allows scammers to exploit unsuspecting borrowers.

B. Manipulative tactics used by scammers: Fake loan apps employ manipulative tactics such as aggressive marketing techniques, unsolicited calls and messages, and enticing offers to lure individuals into their trap.

C. Data privacy and security concerns: Many fake loan apps collect extensive personal and financial information during the loan application process.

This raises concerns about the misuse of sensitive data and the potential for identity theft.

III. Government action against fake loan apps

A. Reserve Bank of India‘s (RBI) crackdown: The RBI has recognized the growing threat of fake loan apps and has initiated several measures to combat the issue.

It conducts regular audits of lending platforms and takes strict action against non-compliant entities.

B. Collaborative efforts with law enforcement agencies: The RBI collaborates with state police and cybercrime units to identify and apprehend individuals involved in operating fake loan apps.

Joint operations and coordinated efforts have led to several arrests and shutdowns of scam operations.

C. Amendments to existing laws and regulations: The government has introduced new provisions and guidelines to enhance consumer protection and strengthen the oversight of digital lending platforms.

These measures aim to create a safer lending ecosystem and deter fraudulent practices.

IV. How to identify fake loan apps

A. Research and verify app credibility: Before downloading or using a loan app, conduct thorough research to verify its credibility.

Check the official website, contact information, and customer reviews to ensure its legitimacy.

B. Scrutinize app permissions and privacy policy: Carefully examine the permissions requested by the app during installation.

Ensure that the permissions align with the app’s legitimate purpose. Additionally, review the app’s privacy policy to understand how it handles and protects user data.

C. Evaluate user reviews and ratings: Read reviews and ratings of the loan app on reliable platforms. Be cautious of apps with an overwhelming number of positive reviews, as they could be fabricated to deceive users.

D. Exercise caution with app requests for personal information: Be wary of loan apps that ask for excessive personal details or financial information beyond what is necessary for loan processing.

Legitimate lenders typically require basic identification and income-related information.

How these loan apps are dangerous for people?

Lack of regulatory oversight: The rapid growth of digital lending platforms has outpaced regulatory frameworks, making it easier for fake loan apps to operate unchecked.

Manipulative tactics used by scammers: Fake loan apps often employ aggressive marketing techniques, such as unsolicited messages, phone calls, and social media advertisements, to target vulnerable individuals seeking loans.

Data privacy and security concerns: Many fake loan apps collect extensive personal and financial information, putting users’ data at risk of misuse or identity theft.

Government Action against Fake Loan Apps:

RBI’s crackdown: The Reserve Bank of India has taken stringent measures to curb the menace of fake loan apps, conducting audits and imposing penalties on non-compliant lenders.

Collaborative efforts with law enforcement agencies: The RBI, in coordination with state police and cybercrime units, has conducted numerous raids and arrests of individuals involved in operating fake loan apps.

Amendments to existing laws and regulations: The government has introduced new provisions and guidelines to enhance consumer protection and strengthen the oversight of digital lending platforms.

How to Identify Fake Loan Apps:

Research and verify app credibility: Conduct a thorough background check of the lending app, including its official website, contact information, and customer reviews.

Scrutinize app permissions and privacy policy: Read the permissions requested by the app carefully and ensure they align with its legitimate purpose. Check if the app has a comprehensive privacy policy in place.

Evaluate user reviews and ratings: Assess the experiences of other users by reading reviews and ratings on reliable platforms. Be cautious of apps with an overwhelming number of positive reviews.

Exercise caution with app requests for personal information: Be wary of apps that ask for excessive personal details or financial information beyond what is necessary for loan processing.

Safeguarding Against Fake Loan App Scams:

Use trusted financial institutions and lenders: When seeking loans, opt for established and reputable Banks or NBFCs (Non-Banking Financial Companies) that adhere to regulatory norms.

These institutions have established mechanisms for customer protection and are less likely to be involved in fraudulent activities.

Beware of unrealistic promises and high interest rates: Fake loan apps often entice borrowers with offers of extremely low interest rates or guaranteed approvals, regardless of credit history.

Be cautious of such claims, as they are often too good to be true.

Research and compare loan offerings from multiple lenders to get a realistic understanding of interest rates and terms.

Scrutinize the app’s terms and conditions: Carefully read and understand the terms and conditions of the loan app before proceeding.

Pay attention to hidden fees, prepayment penalties, and any clauses that seem unreasonable or suspicious.

Legitimate lenders provide transparent information about loan terms, fees, and repayment schedules.

Protect personal information: Be cautious about sharing sensitive personal and financial information.

Legitimate loan apps usually require standard information such as identification documents, proof of income, and bank account details.

However, be cautious if an app requests unnecessary or excessive personal information. Ensure that the loan app has robust data security measures in place to protect your information.

Regularly monitor your financial transactions: Keep a close eye on your bank statements, credit card bills, and any loan-related transactions.

Promptly report any suspicious or unauthorized transactions to your bank or financial institution.

Early detection of fraudulent activity can help minimize the impact and prevent further losses.

Educate yourself about common scams: Stay informed about the latest scams and tactics used by fraudsters.

Be wary of phishing emails, fake websites, and unsolicited calls or messages asking for personal or financial information.

Avoid clicking on suspicious links or downloading attachments from unknown sources.

How To Complaint about Fake Loan Apps and Harassment In India?

Report suspected scams to relevant authorities:

If you encounter a fake loan app or believe you have been a victim of a scam, report it immediately to the Reserve Bank of India’s helpline or the local police cyber crime cell.

Providing details and evidence can help authorities take appropriate action against scammers and prevent further victims.

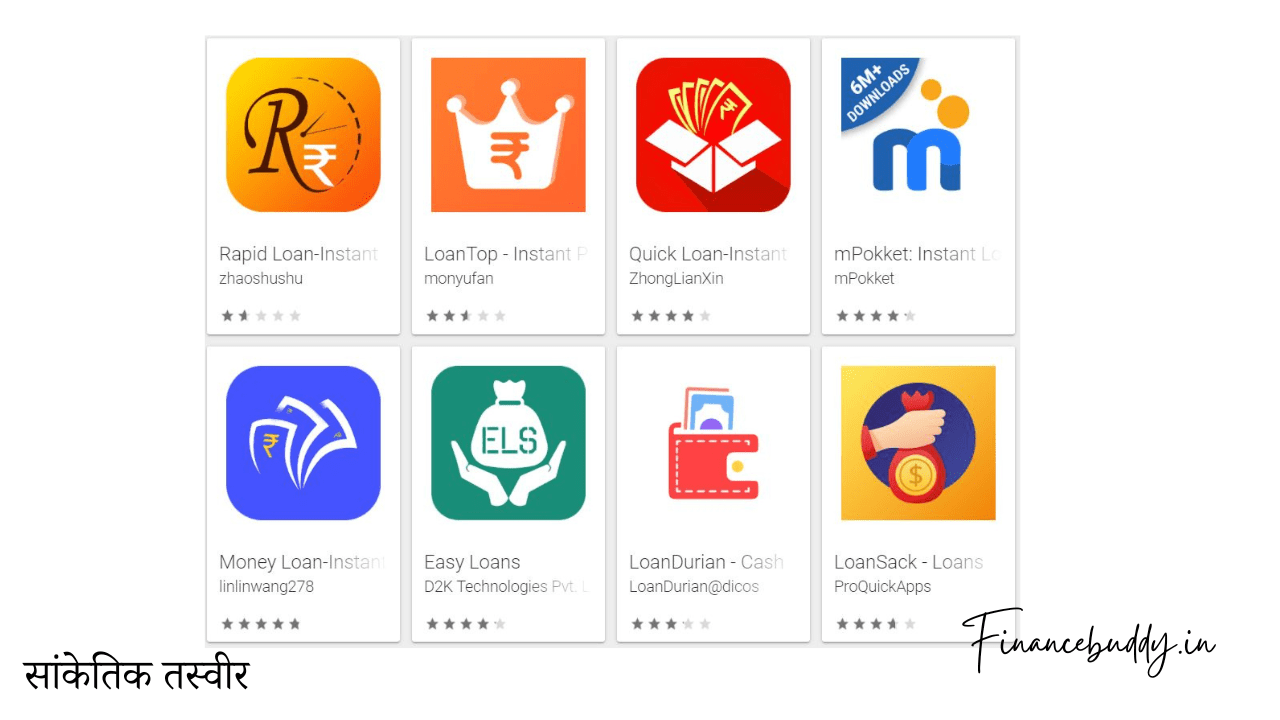

Fake Loan App List

RBI has banned hundreds of fake Chinese loan apps along with similar other local loan apps in India.

Here is the list of a few banned or not approved loan apps in India.

| SR. NO. | FAKE LOAN APP NAME | SR. NO. | FAKE LOAN APP NAME | SR. NO. | FAKE LOAN APP NAME | SR. NO. | FAKE LOAN APP NAME |

| 1 | Agile Loan app | 81 | Easy credit | 161 | Loanzone | 241 | Rupeek buzz |

| 2 | Aladdin Lamp | 82 | Easy Credit Loan App | 162 | Lucky Loan App | 242 | Rupeek cash |

| 3 | Angel Loan | 83 | Easy loan | 163 | Lucky Wallet | 243 | Rupeek fenta |

| 4 | Apna Paisa | 84 | EasyCash Loan | 164 | M pocket* | 244 | Rupeeking |

| 5 | Apple cash | 85 | Easy Rp | 165 | MagicCash Loan App | 245 | Rupeeok |

| 6 | Ariaeko Lone | 86 | Elephant Cash | 166 | Magic Money | 246 | Rupeeplus |

| 7 | Asan Loan | 87 | Es Loan | 167 | Magicc Loan | 247 | Rupeeredee Loan App |

| 8 | ATD lone | 88 | Eulavt App | 168 | Mama Loan | 248 | Rupeestar |

| 9 | Balance lone | 89 | Express loan | 169 | Magicc Loan App | 249 | Rupiya bus |

| 10 | Basket loan | 90 | Express Loan | 170 | Marvel cash | 250 | Rupiya company |

| 11 | Bellono Loan | 91 | Fash rupee | 171 | Marwel Loan Baba | 251 | Rush Loan |

| 12 | Bellono Loan App | 92 | Fast cash | 172 | Matero Finance | 252 | Samay Rupee |

| 13 | Best Paisa | 93 | Fast coin | 173 | May Loan | 253 | Sharp corn |

| 14 | Betwinner betting | 94 | Fast Paisa | 174 | Mi Rupe | 254 | Sharp Loan |

| 15 | Bharat Cash | 95 | Fast cash | 175 | Minute Loan App | 255 | Simple Loan App |

| 16 | Bright Cash | 96 | Fast rupee Loan App | 176 | Minute cash | 256 | Shuttle Loan |

| 17 | Bright money | 97 | Fast Rupee | 177 | Minutes In Cash | 257 | Silver Pocket |

| 18 | Buddy Loan | 98 | Fexli Loan | 178 | Mo Cash | 258 | Simple Loan |

| 19 | Bus rupee | 99 | First Cash | 179 | Mobikquick | 259 | Sky Loan |

| 20 | Bharat Cash App | 100 | Flash Loan App | 180 | Mobile cash | 260 | Slice pay |

| 21 | Clear Loan | 101 | Flash Loan Mobile | 181 | Monday money app | 261 | Small Loan |

| 22 | Cash Advance | 102 | Flash rupee | 182 | Money box | 262 | Small Cash Loan App |

| 23 | Cash Advance | 103 | Flip cash | 183 | Money Ladder | 263 | SmalLoan App |

| 24 | Cash Advance Atach | 104 | For Pay | 184 | Money lander | 264 | Smart Coin |

| 25 | Cash Advance T1 | 105 | Forpay app | 185 | Money Master | 265 | star loan |

| 26 | Cash advance | 106 | Fortress Loan App | 186 | Money Master App | 266 | Store Loan |

| 27 | Cash Book | 107 | fortune now | 187 | Money muthual | 267 | Sun cash |

| 28 | cash bowl | 108 | fresh loan | 188 | Money pocket | 268 | SUN CASH |

| 29 | Cash Carry App | 109 | Fri Loan | 189 | money stand pro | 269 | Sunny loan |

| 30 | Cash Cola | 110 | Funny happen | 190 | Money standup | 270 | Time loan |

| 31 | Cash colla | 111 | Get Cash | 191 | Money tree | 271 | Top Cash |

| 32 | Cash cow App | 112 | Gold Cash | 192 | money stand pro App | 272 | tree lone |

| 33 | Cash Cow | 113 | Gold loan app | 193 | Money View App | 273 | Tyto Cash |

| 34 | Cash Credit | 114 | Gold Sea | 194 | Monney Tank | 274 | Unit Cash |

| 35 | Cash curry | 115 | Gold cash | 195 | More cash | 275 | UPA Loan |

| 36 | Cash fish | 116 | Goldman Payback | 196 | More Cash App | 276 | UPO Loancom |

| 37 | Cash go | 117 | Guru loan app | 197 | More Loan | 277 | Voice loan |

| 38 | Cash Guru App | 118 | Hand Cash | 198 | My Cash Loan | 278 | Volcano Loan |

| 39 | Cash Magic | 119 | Hand Cash Friendly Loan | 199 | My Kredit | 279 | Wallaby App |

| 40 | Cash Hole | 120 | Handey Loan | 200 | Name of app | 280 | Wallet Payee |

| 41 | Cash Host Loan App | 121 | Handy loan | 201 | Ob cash loan | 281 | Apna Paisa |

| 42 | Cash Host | 122 | Hello Box | 202 | ob cash loan App | 282 | Wallet Pro |

| 43 | Cash Machine | 123 | Hello Rupee | 203 | Ok Rupee Loan App | 283 | Warn Rupee |

| 44 | Cash Machine Loan | 124 | Hi Credit App | 204 | One Loan Cash Any Time | 284 | When Credit |

| 45 | Cash Magic | 125 | Holiday Mobile Loan | 205 | One loan easy loan | 285 | Wow Rupee |

| 46 | Cash manager | 126 | Honey Loan | 206 | Onstream | 286 | Yes Cash |

| 47 | Cash Manager | 127 | Honey Loan App | 207 | Orange Loan | 287 | Yes Rupees |

| 48 | Cash Mine | 128 | Holiday Mobile | 208 | Orange Loan | 288 | Zo zo Cash |

| 49 | Cash Papa | 129 | Hoo Cash | 209 | Paisawala | 289 | Cash port |

| 50 | Cash Park Loan App | 130 | Hu cash | 210 | Personal Loan App | 290 | Alp cash |

| 51 | Cash park | 131 | I Credit | 211 | Phone pay | 291 | Angel Loan |

| 52 | Cash Park Loan | 132 | I karza | 212 | Pillai Loan | 292 | Apna Paisa |

| 53 | Cash Pocket | 133 | Income loan | 213 | Plump Wallet | 293 | Asana Loan |

| 54 | cash pocket live Cash | 134 | Income OK | 214 | pocket bank | 294 | Cash Curry |

| 55 | Cash Samosa | 135 | IND loan | 215 | Pokemoney | 295 | Cash era |

| 56 | Cash Star Miniso Rupee | 136 | India AI Credit Cash Loan | 216 | PradhanmantriYojna Loan | 296 | Cash lion |

| 57 | Cash Station | 137 | Infinity Cash | 217 | Pub cash | 297 | Cash Star Miniso Rupee |

| 58 | Cash Carry Loan App | 138 | Insta Loan | 218 | Quality cash | 298 | Cashon |

| 59 | Cashcom | 139 | Insta money | 219 | Quality Cash Loan App | 299 | Coco cash |

| 60 | Cashpal | 140 | Jo Cash | 220 | Quick Loan App | 300 | Credit finch |

| 61 | Clear Loan | 141 | Just paise Loan App | 221 | Rapid | 301 | Dhani |

| 62 | Coin Rupee | 142 | Just money | 222 | Rainbow Loan | 302 | Early Credit App |

| 63 | Crazy Cash | 143 | Kash loan | 223 | Rapid Paisa | 303 | Elephant loan |

| 64 | Credit buzz | 144 | Koko cash | 224 | Reliable Rupee Cash | 304 | Eye Credit |

| 65 | Credit Loan | 145 | Koko Loan | 225 | rich cash | 305 | Fast Paisa |

| 66 | Crystal Loan | 146 | Koko loan | 226 | Rich Loan Go | 306 | Fast Rupee |

| 67 | Credit Pearl | 147 | Lend Mall | 227 | Rocket Loan | 307 | First Cash |

| 68 | credit wallet | 148 | Link Money | 228 | Royal able rupee cash | 308 | Flash Loan Mobile |

| 69 | Crystal Loan | 149 | Live Cash Loan App | 229 | Royal cash | 309 | Go cash |

| 70 | Daily Loan | 150 | Live Cash | 230 | Rupee Box | 310 | Hand Cash |

| 71 | Dhan Pal | 151 | Loan Cube | 231 | Rupee Loan | 311 | Ind Loan |

| 72 | Discover Loan App | 152 | loan cube | 232 | Rupee Cash Loan | 312 | Insta Loan |

| 73 | Dream loan | 153 | Loan dream App | 233 | Rupee Magic | 313 | Insta Money |

| 74 | DuttaRuppes | 154 | Loan Dream | 234 | Rupee mall | 314 | Lend Mall |

| 75 | E Paisa | 155 | Loan fortune | 235 | Rupee Online | 315 | Live Cash |

| 76 | Eagle cash loan App | 156 | Loan Fortune | 236 | Rupee Papa | 316 | Loan Resource (DIC) |

| 77 | Early Credit App | 157 | Loan Home Small | 237 | Rupee pocket | 317 | Loan tap |

| 78 | Easy Barrow Loan App | 158 | Loan Loji | 238 | Rupee salam | 318 | Loan zone |

| 79 | Easy Borrow Cash loan | 159 | Loan Resource | 239 | Rupee smart | 319 | Loanzone |

| 80 | Easy brave | 160 | Loan Sathi | 240 | Rupee Star | 320 | Micredit |

Read- RBI Approved Loan Apps List

So many apps were available on Google Playstore and Apple App Store with many different name variations just to make people confuse and make easy targets.

The prevalence of fake loan apps in India poses a significant threat to individuals seeking financial assistance.

Understanding the important points, recognizing government actions, and learning how to identify and safeguard against these scams are crucial steps to protect oneself from financial fraud.

By staying vigilant, using trusted lenders, and exercising caution when sharing personal information, individuals can minimize the risk of falling victim to fake loan app scams and ensure a secure borrowing experience.

Leave a Comment